This forecast is provided in a new report jointly released by the Indian government think tank NITI Aayog and the India office of the non-profit research organization Rocky Mountain Institute (RMI).

Meanwhile, an evaluation process is underway. India hopes to achieve an annual production capacity of 50GWh of batteries at as many as 10 new Advanced Chemical Battery (ACC) production facilities through the Production Linked Incentive (PLI) scheme.

The report explains the drivers behind this urgent need, with India pledging more than $2 billion in financial assistance to battery producers building gigafactories in the country, each with a battery capacity of at least 5GWh per year.

According to the policy set by the Government of India, in addition to achieving the target of deploying 500GW of renewable energy generation facilities by 2030 (which the country is expected to achieve given that the combined installed capacity of solar power generation facilities and wind power generation facilities has reached 175GW), by 2030 In 2019, 30% of new vehicles in India will be electric vehicles.

Globally, the report's authors cite data from Bloomberg New Energy Finance, which predicts that the global energy storage market will be worth $150 billion by 2030. According to RMI and NITIAayog, India alone could account for 13% of total demand due to the high penetration of electric vehicles and stationary energy storage.

The growth of the renewable energy market will naturally present a huge market opportunity for stationary energy storage systems because of the wide variety of services they can provide, and falling costs mean that battery storage systems are competing with existing energy storage technologies.

Provide a broad value stream to a wide range of stakeholders

The report identifies six key drivers for accelerating battery manufacturing in India:

• The central role of batteries in taking climate action, in line with India's Nationally Determined Contribution (NDC) to achieve net zero emissions by 2070 and 50% of its energy use from non-fossil fuels by 2030.

• India currently imports not only a large amount of fossil fuels, but also equipment and materials for renewable energy projects such as photovoltaic modules and lithium-ion batteries. The development of domestic manufacturing in India will have a positive impact on the national energy security.

• India accounts for 22 of the 30 cities with the most polluted air quality globally, according to the IQAir index released. Clean energy and electric transport offer ways to reverse this adverse trend.

• Electric vehicle adoption targets will undoubtedly drive greater demand for batteries.

• Greater involvement in battery manufacturing provides more opportunities for Indian industry to grow.

• The falling cost of batteries makes them feasible in an increasing number of applications.

The report indexes battery market opportunities through 2030 in a range of applications: stationary energy storage, grid support ancillary services, renewable energy integration, transmission and distribution (T&D) upgrade delays, grid-side energy storage (BTM) ) will be a very attractive market by 2030.

In the case of grid services, it does depend on the ability of regulators to allow battery storage to participate in the wholesale market for ancillary services, which seems increasingly likely to happen.

The Indian Grid Transmission Utilities and Distribution Company (DISCOM) has many different energy storage systems available to support grid reliability and efficiency.

Energy storage is one of the assets used to meet power demand during peak periods, which has so far largely driven investment in natural gas peaking power plants.

As other markets such as the U.S. are beginning to see, utilities can defer the need to invest in distribution system upgrades in areas of the grid where rapid power demand growth is occurring or expected. Likewise, deploying energy storage systems can alleviate the need for costly transmission system upgrades.

Likewise, as has been seen in many parts of the world, the immediate benefits of battery energy storage systems adoption by utility companies include smoothing and stabilizing renewable energy output, voltage support and frequency regulation ancillary services, black starts and electricity in the event of a blackout or grid incident backup power, etc.

Indian market demand to reach $15 billion by 2030

According to the data of the Indian Energy Storage Alliance (IESA), the battery energy storage system currently under construction or already online in the country is only about 85MWh, but there is already a planned deployment target of 4.6GWh (including 3.4GWh planned for bidding and 1.2GWh announced to the public). ).

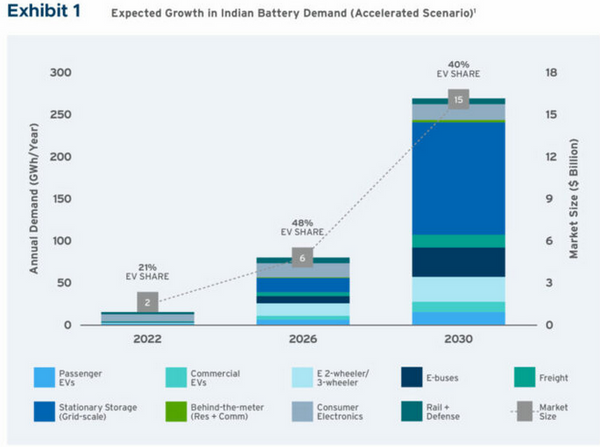

In the report, RMI and NITI Aayog proposed two scenarios, a conservative one and an accelerated adoption of battery energy storage systems. In the accelerated plan (260GWh), India will have a market demand of US$15 billion by 2030, of which US$3 billion will be used for battery energy storage systems and US$12 billion will be used for battery production.

It’s worth noting that while EVs get more attention, they only account for around 40% of total demand, including freight applications, while grid-scale stationary energy storage systems will be roughly equal, or more.